.png)

.png)

Welcome to First Bank & Trust Co.!

We are excited to transition your account(s) from The First National Bank of Lindsay to First Bank & Trust Co., aiding in the service of Lindsay and the surrounding communities! This transition is a data system conversion where we pull your FNB accounts, convert them to a comparable FBTC account, and input that information into our system. Please know we are working diligently behind the scenes to ensure a smooth, seamless transition. It has been established that some critical information in the FNB system is missing, old or outdated. Please verify your phone number, date of birth, mailing address, and email address by calling (405) 756-4433 or visiting the Lindsay banking center to ensure accurate information is transferred. You are at the top of our minds and our FIRST priority. Please reference this Transition Guide to help you prepare for the transition of The First National Bank of Lindsay to First Bank & Trust Co., March 28-30, 2025.

If you have any questions, please give us a call at (405) 756-4433.

First Things First – Let’s talk Transition Time!

On March 28, we will begin the conversion of accounts from FNB to FBTC. At the opening of business on March 31, 2025, the transition will be complete and your account(s) will officially be on our system.

What Can I Expect As The Transition Occurs?

Our goal is to make the transition process as seamless as possible.

Once you’ve reviewed the information in this guide, we encourage you to contact us for assistance if you have additional questions or concerns.

First National Bank of Lindsay Transition to First Bank & Trust Co.

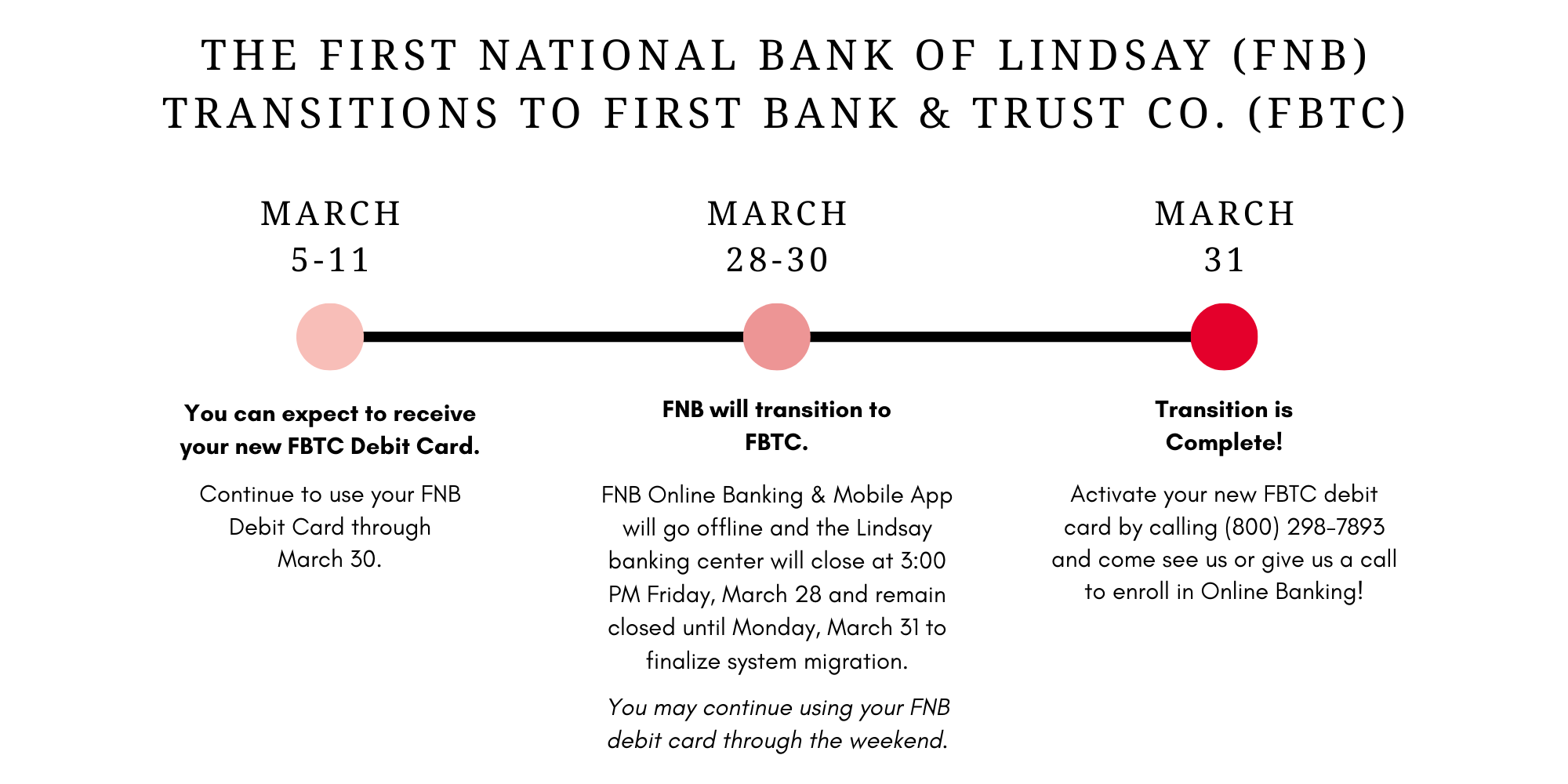

March 5 – 11

You can expect to receive your new First Bank & Trust Co. Debit Card between March 5 and March 11, but please do not activate it before March 31.

March 28 - 30

We will begin the system migration process at 3:00 PM on Friday, March 28. As part of this upgrade, the Lindsay banking center will close at 3:00 PM on March 28 and FNB’s Online Banking & Mobile App will go offline.

The Lindsay banking center will remain closed on Saturday March 29 and will reopen with normal operating hours on Monday, March 31. During this time, the ATM will remain available for your convenience. We appreciate your patience and look forward to bringing you an improved banking experience!

March 31

The banking center will open for normal operating hours. All FNB accounts will now have transitioned to FBTC accounts. While our goal is to retain your account number, a small number of checking and savings account numbers will need to be updated as part of the conversion process. If your account number is changing, you will be notified by mail.

Checks/ACHs/Direct Deposit

You can begin to use your new First Bank & Trust Co. Debit Card(s) and bank routing number (103102106) starting March 31:

- Confirm with all automatic payment and direct deposit sources that your account number and routing number have been updated.

- Even if your account number changes, you may continue to use your existing checks until it is time to reorder.

Rest assured, all outstanding checks and direct deposits will continue to process as normal.

Debit Cards

- Your current FNB Debit Card will work through March 30.

- You can expect to receive your new Debit Card between March 5 and 11. If you do not currently have an active Debit Card, you will not receive one.

- If you do not receive your new Debit Card, please give us a call at (405) 756-4433.

- Starting March 31, Instant Issue Debit Cards will be available at the Lindsay banking center!

- Activate your new FBTC Debit Card and set your PIN by calling the activation line at (800) 290-7893 on March 31.

- You can begin using your new card once it is activated.

- Cut up or shred your First National Bank of Lindsay Debit Card(s).

- Update any automatic or recurring charges you were paying with your FNB Debit Card. Our Switch Kit is available to help you identify automatic deposits and/or recurring deductions.

Fraud Watch

We’re thrilled to offer enhanced account security with Fraud Watch! Our dedicated Fraud Center is constantly working to safeguard your funds. To ensure your protection, you may occasionally receive text messages or phone calls from our Fraud Center at (800) 237-8990 or short number 96923.

Online Banking

First National Bank of Lindsay Online Banking & Mobile App will go offline on Friday, March 28. You will no longer have access.

Your Online Banking enrollment will not transition over. You will need to visit our branch or call in to enroll.

Please be aware that FNB Online Bill Pay will no longer be available when Online Banking goes offline on March 28. If you have automatic payments scheduled through FNB Online Bill Pay, please make alternate arrangements for payment during the transition period. FBTC proudly offers Online Bill Pay through our Online Banking and Mobile App, available to you starting March 31. We encourage you to enroll and set up your bill payments as soon as possible to ensure you don't miss any payments.

Once you’ve successfully enrolled in Online Banking, make sure to download our FREE mobile app to experience the easiest way to bank! Our app provides you with 24/7 access to your accounts wherever you are, as well as innovative features like:

- MyCardRules™ - Advanced Debit Card Controls, Turn ON & OFF, Set Limits, Alerts

- Bank to Bank Transfers – Transfers between your account(s) at First Bank & Trust Co. and other financial institutions.

- Transaction Tagging – Keep track of where you’re spending your money for easier budgeting.

- Mobile Deposit – Submit your check(s) for deposit anywhere, anytime.

Download our app from Google Play or the App Store®.

Your Guide to First Bank & Trust Co. Accounts

The following information is an at-a-glance look at First Bank & Trust Co. accounts. While we have done our best to convert your account to a comparable option, please remember we have a wide range of checking and savings account options for you. Please refer to our website, www.fb247.com, for more details on our account offerings.

|

Consumer Checking & Savings Accounts |

Account Terms |

|

First Freedom |

|

|

First Class |

|

|

First Class Plus (Available to individuals age 62 or older) |

|

|

First Hero (A specialty account for active and retired Military personnel, certified law enforcement, firefighters, licensed educators, licensed healthcare professionals, and registered farmers and ranchers) |

|

|

First Rate |

|

|

First Advantage |

|

|

First Money Market |

|

|

First Savings |

|

** Overdraft Privilege (ODP) is not automatic, so you must opt-in. A non-sufficient fee of $30 will be charged for each transaction initiated for payment from your checking account that does not have sufficient collected funds. This fee will be included in and counted against your assigned overdraft limit. Our NSF/OD fee may be imposed for paying or not paying overdrafts created by checks, in-person withdrawals, ATM withdrawals, or other electronic means. We reserve the right to require you to pay your outstanding overdraft (negative) balance, including our fees, immediately or on demand. Whether your overdrafts will be paid is at our sole discretion, and we reserve the right to not pay. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you have too many overdrafts.

Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks). We use the daily balance method to calculate interest on your account. This method applies a daily periodic rate to the principal in the account each day. Interest rates may change at any time at the bank’s discretion.

|

Commercial Checking & Savings Accounts |

Account Terms |

|

Free Business |

|

|

Commercial Checking |

|

|

Interest Commercial Checking |

|

|

Commercial Savings |

|

|

Commercial Money Market |

|

**Overdraft Privilege (ODP) is only available for Sole Proprietorships. Corporations, Partnerships, and LLCs are not eligible for ODP. ODP is not automatic, so you must opt-in. A non-sufficient fee of $30 will be charged for each transaction initiated for payment from your checking account that does not have sufficient collected funds. This fee will be included in and counted against your assigned overdraft limit. Our NSF/OD fee may be imposed for paying or not paying overdrafts created by checks, in-person withdrawals, ATM withdrawals, or other electronic means. We reserve the right to require you to pay your outstanding overdraft (negative) balance, including our fees, immediately or on demand. Whether your overdrafts will be paid is at our sole discretion, and we reserve the right to not pay. For example, we typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits, or you have too many overdrafts.

Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks). We use the daily balance method to calculate interest on your account. This method applies a daily periodic rate to the principal in the account each day. Interest rates may change at any time at the bank’s discretion.

First Bank & Trust Co.

Schedule of Fees - Effective April 14, 2025

Fees that may be assessed for bank services

|

E-Banker – Online Banking |

FREE |

|

E-Pay – Online Bill Pay Monthly Maintenance Fee |

FREE |

|

E-Pay – Excess Item Fee (first 7 items per statement cycle free) |

$ 0.50 |

|

Mobile Banking |

FREE |

|

FirstLine 1-888-306-BANK (2265) |

FREE |

|

Notary Service |

FREE |

|

ATM/Check Card Monthly Fee |

FREE |

|

Foreign ATM Transaction |

$ 2.00 |

|

International ATM Fee |

$ 5.00 |

|

ATM/Check Card Replacement |

$ 5.00 |

|

Telephone Transfer Fee |

FREE |

|

Sweep Transfer Fee |

FREE |

|

Collection Item Fee (Each) |

$ 7.50 |

|

Garnishment Fee |

$ 30.00 |

|

Levy Fee or Other Legal Fee |

$ 30.00 |

|

Copy Fee (Per Page) |

$ 0.25 |

|

Insufficient Funds (NSF) Returned Item Charge |

$ 30.00 |

|

Insufficient Funds (NSF) Paid Item Charge |

$ 30.00 |

|

Overdraft Privilege (OD Priv) Paid Item Charge |

$ 30.00 |

|

Returned/Reprocessed Item Fee |

$ 5.00 |

|

Dormant Account Charge (Monthly Charge) |

$ 5.00 |

|

Wire Transfer (Outgoing) – Customer |

$ 15.00 |

|

Wire Transfer (Incoming) – Customer |

$ 10.00 |

|

Wire Transfer (Outgoing International) – Customer |

$ 45.00 |

|

Wire Transfer (Incoming International) – Customer |

$ 25.00 |

|

Wire Transfer (Outgoing) – Non-Customer |

$ 30.00 |

|

Wire Transfer (Incoming) – Non-Customer |

$ 30.00 |

|

Wire Transfer (Outgoing International) – Non-Customer |

$ 60.00 |

|

Account Research (Per Hour/1 Hr Min) |

$ 25.00 |

|

Cashier’s Check Fee – Customer |

$ 5.00 |

|

Cashier’s Check Fee – Non-Customer |

$ 10.00 |

|

Stop Payment Order Fee |

$ 30.00 |

|

Caution Fee (For 90 Days) |

$ 30.00 |

|

Snapshot/Temporary Statement |

$ 2.00 |

|

Statement Reconciliation (Per Hour/1 Hr Min) |

$ 20.00 |

|

Fax Fee (Per Page) |

$ 1.00 |

|

Gift Cards – Fee Per Card |

$ 5.00 |

|

Overdraft Accrual Charge – Commercial Accounts: |

|

|

Daily Fee Assessed on Overdrawn Balance |

$ 4.00 |

|

Interest Charged on Overdrawn Balance |

18% APR |

|

Overdraft Accrual Charge – Consumer Accounts: |

|

|

If overdrawn more than 5 days, by more than $10.00 (Daily Fee) |

$ 1.00 |

|

*Dormant accounts are accounts with no activity (other than interest crediting) or contact from the depositor for more than 24 months. **Caution – Temporary watch on a checking account for lost or stolen checks. |

|

Additional FAQs

Daily Cut-off Time

Beginning March 31, End of Day Processing for First Bank & Trust Co. will be 6:00 PM CST Monday through Friday. Any items that come in after 6:00 PM CST Monday through Friday will process the next business day.

What Additional Services Does First Bank & Trust Co. Offer?

We proudly offer an array of services that one would need to bank confidently! Check out our Additional Services and Online & Mobile Banking webpages to see how we can help you bank easily.

Are you a business owner? As a community bank, we pride ourselves on partnering with businesses to build a strong community. With our Treasury Management Services, you’ll have everything you need to maintain seamless and secure cash flow throughout all operations of your business.

Are you planning your future? Our Wealth Management & Investments department comprises experts ready to help you take charge of your future – whether personal or business – through Estate Planning, Individual Retirement Accounts, and More. *Non-deposit investment products are not insured by the FDIC, are not deposits, and may lose value.*

What Miscellaneous Charges Does First Bank & Trust Co. Have, And What Charges Will Be Different?

The First Bank & Trust Co. Schedule of Fees does differ somewhat from The First National Bank of Lindsay. The new Fee Schedule will take effect on Monday, April 14, 2025.

Does First Bank & Trust Co. Offer Visa Gift Cards?

Yes, we do! And they make the perfect gifts! Gift Cards can be loaded with amounts from $20 - $750 and can be used anywhere VISA is accepted, excluding ATMs.

Policies & Disclosures

First Bank & Trust Co. Funds Availability Policy

Our general policy is to allow you to withdraw funds deposited in your account on the first business day after we receive your deposit. Funds from electronic direct deposits will be available on the same day as we receive the deposit. In some cases, we may delay your ability to withdraw funds beyond the first business day. Then, the funds will generally be available by the second business day after the day of deposit. If we cash a check for you that is drawn on another bank, we may withhold the availability of a corresponding amount of funds already on deposit in your account. Generally, those funds will be made available to you at the time funds from the check we cashed would have been available if you had deposited it.

First Bank & Trust Co. Privacy Policy

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Review the full First Bank & Trust Co. Privacy Policy on our website.

First Bank & Trust Co.

Orig: 3/7/2025