As a community bank, we pride ourselves on partnering with businesses to build a strong community.

With Treasury Management services from First Bank & Trust Co., you'll have everything you need to maintain seamless and secure cash flow throughout all operations, as well as the peace of mind that comes from working with a partner you trust.

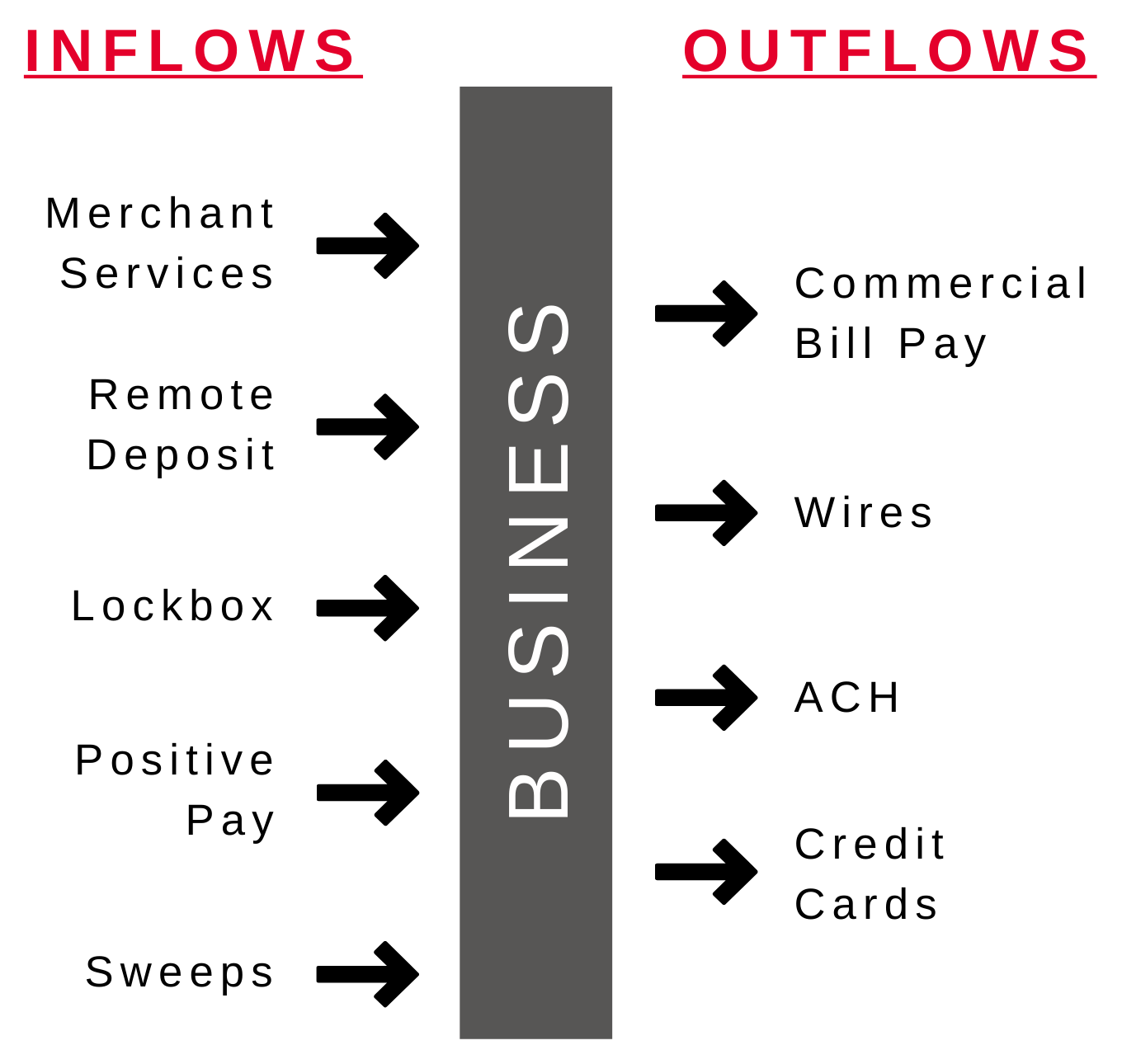

Our extensive suite of Treasury Management services helps with the day-to-day administration of cash flow, maximizing business stability, operations, and growth.

First Bank & Trust Co. recognizes the unique needs of individual businesses. Therefore, we cater our services based on your company, supplying all the financial tools and efficiencies to streamline your financial processes.

Lockbox

With the Lockbox service from First Bank & Trust Co., you can reduce your expenses, improve the efficiency of remittance processing, and streamline your accounts receivable functions.

Maintaining an organized payment collection process can be an overwhelming task for many businesses, especially when they receive large volumes of payments and correspondence via mail.

We can help ease that stress and expedite your collections by managing payments in a more simplified and secure method.

Payments and correspondence are routed to a secure location where they are collected, fully imaged, and processed to your account. Custom reports are then made available.

This service can greatly benefit the following:

- Municipalities

- Property Management Groups

- Medical Offices

- Co-Ops

- Insurance Companies

- Non-Profits

Merchant Services

First Bank & Trust Co. can help increase your sales revenue by supplying your business with the tools and requirements it needs to accept debit cards, credit cards, and other electronic payments.

With both Point of Sale (POS) and Virtual terminals, our merchant solutions provide your customers the convenience and flexibility of multiple payment methods.

Utilizing our sophisticated merchant technology and in-house servicing allows you to focus on what matters most... your customers.

*Seasonal Merchant Services available for businesses open four (4) months or less per yearRemote Deposit

Your deposits just got a whole lot simpler!

Utilizing the convenient Remote Deposit technology from First Bank & Trust Co., you can save time and money by skipping your daily trip to the bank. Scanning checks right from the office speeds up the availability of funds and improves your cash flow. Spend less time making deposits and more time running your business.

Positive Pay

Positive Pay is a fraud prevention tool that allows a check and balance between your business and the bank, saving your business money on ACH and check fraud.

- Check Positive Pay cross-references checks as they clear the bank based on what you say the item should be.

- If there are any discrepancies, the item will be called to action.

- ACH Positive Pay will send all electronic payments for decision initially.

- The decision on the initial item will determine what happens to subsequent payments presented.

Putting these security checks in place ensures efficiency by allowing the bank to cash or reject checks and ACHs without any delays.

ACH

Facilitating payments through Automated Clearing House (ACH), allows you to reduce expenses and expedite payments. ACHs are electronic, bank-to-bank transfers that are more secure, cost-efficient, and timely than regular check payments.

How could your business utilize ACH?

- Invoicing

- Vendor Payments

- Payroll

- Disbursements

- Dues

- Paperless

- Bank to Bank Transfers

- Payment Collections

Online Bill Pay

- Payables can be sent via ACH or Check

- Allows for multiple users and multiple accounts

- Set up recurring payments

.png)